May 2018

Claims Crackdown!

USTRANSCOM & the MCO communities have made it abundantly clear, both through Advisory 18-0066, and by information passed onto Industry at a recent Claims Prevention and Procedure Counsel workshop.

At last month’s CPPC meeting, MCO’s provided a form/letter that they are going to start using, in order to initiate punitive actions against MCO’s for certain violations. USTRANSCOM has already stated that they do not intend to question the MCO’s – if an MCO sends one of these forms in, punitive action will result. TSP’s need to be aware of this form, and the infractions listed on it. The first four I’m not concerned with, as I know we’re already in compliance. On the 60 days to settle, I can only repeat what I said at last year’s IAM meeting, and that is how it is next to impossible to be able to guarantee that you’re fully staffed enough to comply with this requirement. Volume is inherently hard to predict, and adjustors take a long time to train. For the claims peak (August through October usually), even the good guys could have some challenges with compliance. And of course there’s the last one – “other” – yikes!

I’m hopeful therefore, that MCO’s will focus their punitive power on the truly deserving, and not randomly penalize the masses. I’m optimistic that they will, but it’s concerning.

Rest assured that National Claims Services will do our level best to be at full compliance – and so should you.

January 2018

US Transcom has issued new version of the Claims Business Rules. There are some important changes that we wanted you to be aware of. I’ve attached the full version of the rules, and below I’ve outlined the changes that are the most important in my view.

2.4.1. – Acknowledge requirements – there is a new requirement that we provide an acknowledgement of receipt giving certain info to the customer, much of which we’re already doing. We’ve requested that IT add the new required info, which is to tell the customer that we have 60 days to pay, deny or make an offer. (Note also the contradictory and in my view erroneous sentence added later in the same section – which implies that we must settle the claim within 60 days. This is being addressed by industry, and in the meantime, it’s believed simply to be an error – we have 60 days to enter an offer in DPS, not to obtain acceptance and pay.)

2.7 – Salvage – TSP’s prohibited from pre-emptively deducting salvage before first discussing with customer – I don’t think any of us ever did that, so should not affect us.

2.9.2. – requires a TSP to “allow” setoffs (by accepting in the Syncada system). We successfully lobbied for them to add also the verbiage stating that doing so does not affect our right to appeal the offset.

2.9.4. – denying claims due to it being the fault of a prior TSP (as in when we deny items because damage or loss is noted on an NTS rider) – change in verbiage states that we do not forward to prior TSP, but instead, within 3 business days, we must notify customer and appropriate MCO. We should have already been doing this. This means that when a TSP denies such a claim in DPS, an email should go to the MCO and customer right away, stating that “in accordance with section 2.9.4. of the claims business rules, we hereby notify customer and MCO that we are denying liability for one or more items on this claim due to it being the fault of the previous TSP.” One final note, and that’s if the item isn’t on the inventory taken by the prior TSP, that need not trigger this requirement, as there is no proof of tender to ANY TSP in this case. NCS will implement a policy to comply with this rule.

4.0 – OCIE – pretty convoluted verbiage, but there is a new process for OCIE (military pro-gear that is issued to the soldier by the government). The worst part is that to really comply with the requirement in 4.0.2., which is to notify the MCO within 30 days of receiving notice that OCIE was damaged or lost. To do this, a TSP would have to screen all 1850’s, LD Reports in DPS, Claims, etc. for OCIE, and contact the MCO to let them know. NCS will not provide this service, since quite often we won’t have been sent the file from the client yet. I suspect that most TSP’s will be unable to comply with this rule, so industry will seek to have it changed. In the meantime, at least there is no associated penalty.

The main change however, is that we should now DENY OCIE claims, and tell the MCO. They may later pay and send us a Demand, which we’d have to honor and settle within 60 days as long as it’s reasonable. NCS will immediately take steps to implement this policy.

March 2017

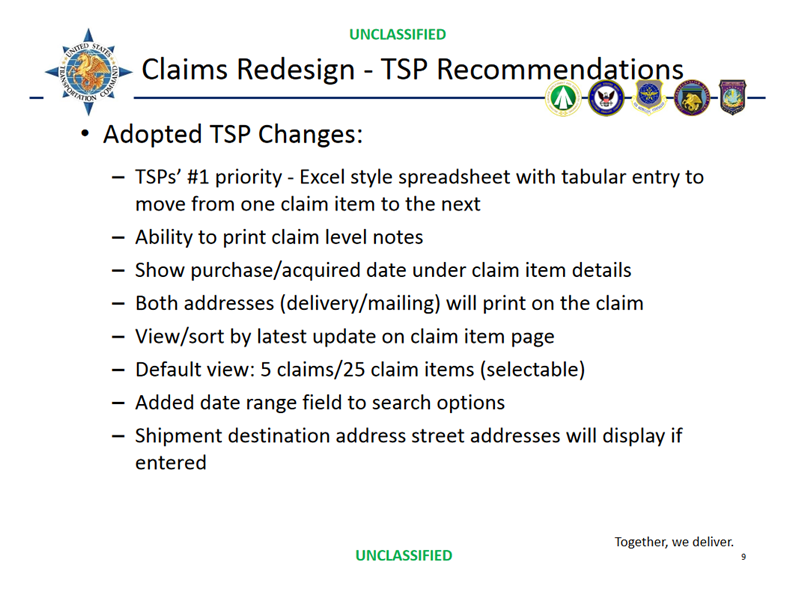

Updated DPS Claims Module (Claims Redesign)

As of this writing, the new claims module was on schedule for a September 22, 2017 release. SDDC also advised at the AMSA conference that they are going to incorporate the industry's number one request, which was to make the interface more efficient to use, by adopting a grid showing multiple items, where all data entry can be done at once. This would be much better than items having to be individually opened and saved, and would enable an adjuster to more efficiently enter offers into the DPS system.

The following slide was presented at the AMSA Convention:

The above recommendation was a result of a face to face meeting between a small industry team, including myself, John Johnson, John Becker, Georgia Angell and Kirra Floyd - and DPS programming contractors in O'Fallon, Illinois. Also recommended by our industry team was to eliminate the unnecessary "Amt Paid to DoD Customer" field, although we are unaware of any progress in getting that change. There were multiple other smaller requests.

CPPC April Workshop

The April "50th Anniversary" CPPC workshop will feature some substantial opportunities to discuss military claims. The MCO's and SDDC are both going to be in attendance, and a special military session will precede the workshop proper. Within the workshop, I will also be moderating a military claims breakout session.

April Fool's 2016 Blog

Despite the many requests we have received regarding our April Fools Blog, I regret to inform our readership that we're not going to stop.

April Fool's 2015 Blog

(Editor's Note: As mentioned in our previous April Fool's Blogs the following post is a joke!)

Volume to Double with Formation of the Department of Offense

TSP's that have been previously concerned with military down-sizing and the prospect of lesser HHG volume by the Department of Defense, need not worry. In a bold move, rumored to have been inspired by Kevin Spacey’s character on House of Cards, the Executive Branch has announced the formation of a giant new governmental agency to work in tandem with DOD. The new agency will be called the Department of Offense, and its creation will result in doubling the volume of shipments available in the current DOD program by 2017. There has also been talk of a third agency, slotted possibly for 2020 – the Department of Special Teams.

DOHA Rules in Favor of Military

In a recent DOHA Decision, a TSP’s use of an appearance allowance was deemed inappropriate, when they refused to allow replacement cost for a broken watch, stating that it was still right twice a day.

Going too Far!

A TSP was upset about being forced to accept liability for a claim they felt was fraudulent. The customer claimed to have a leaking aquarium, a claim which the TSP said just didn’t hold water.

The TSP was sanctioned with a 30 day worldwide suspension, after adding insult to injury by making out a check to the government for a negative sum of money. The TSP’s president was quoted as saying “I always wondered what would happen, and sure enough, when they cashed it, there was more money in our account!”

The Most Interesting Agent in the World

-

They once broke a plate – just to see what it was like

-

Their crew members speak every language, including three that only they know

-

Customers tip them as soon as they get out of the truck.

-

Electronics that have been broken for years, all of a sudden work again

-

Their TSP’s have an average CSS of 183

-

They always disconnect the washing machine – after doing all the member’s laundry

-

Their trailers are used as food trucks during non-peak season, where people come from miles around to eat off the floor

-

They can even move Tempur-Pedic Motorcycles without damaging them

NCS to Handle Inter-Planetary Claims

While the gravity of the decision was great indeed, NCS is now offering their adjudication services on HHG claims on Inter-Planetary shipments.

Port Congestion

It has been mentioned so often in recent months, that we have finally discerned that it does not, in fact, refer to the inability to breathe out of one’s left nostril.

June 2014

Working Together with the MCO Community

Whether it was a shared adversity in the form of DPS, or just good people, the industry has been very fortunate in the last few years to have had the chance to work with the current group of leaders at the MCO level. We may not always agree, and we may have strongly opposing views on some issues, but there is a level of respect and trust on both sides that (in my personal view) that has been all too rare in the past, when industry and government representatives came together. It is important that we try to maintain that good relationship going forward, and here are a couple of things that we’ve done, as we try to do just that.

Jointly Authored Article on Repair Estimates – Steve Kelly and myself recently completed a jointly written article about repair estimates, which appeared in the most recent CPPC newsletter. The article addresses our views of how repair firms should handle repairs, inspections, etc. and can be found here.

Visit to Air Force Claims Service Center – Rick Curry, the current chairman of the IAM Claims Committee and myself recently paid a visit to Wright Patterson, to sit down with Mr. Brett Coakley and Mr. J.D. Reese of the AFCSC. We particularly wanted to talk about the DPS Claims Module, before the current efforts to revamp claims module interface get too far along. We were then given the opportunity to make a full presentation of the DPS claims interface from the TSP point of view, and to make our case for certain changes which would greatly improve the claims process, not just for the TSP but for the service member.

In addition to the MCO personnel listed above, I would also like to mention Ms. Virginia Eilmus from Navy Claims, as somebody that will really listen to our concerns, and work with us not just as adversaries, but as partners in our effort to improve the claims process for all stakeholders.

May 2014

The Mold Rules are Done!

On Tuesday, April 22, SDDC posted the updated version of the DTR Chapter 410, which included instructions to the PPSO from the new mold rules. They can be seen here, on page 10. The "TSP Version" is actually going to be inserted into the Claims Liablity Business Rules, but you can view the new insert here.

These rules provide important direction to PPSOs and TSPs alike, when a mold problem is found. They also provide for the TSP to be reimbursed for expenses incurred for mold mitigation, when found not to be at fault for the mold. (see specifics in the document itself.)

2014 April Fool's Blog

(Editor’s Note: Ideally I’d stay quiet about the April Fool’s thing, and let folks figure it out for themselves. But sure enough, as soon as I’d do that somebody would believe this malarkey, do something silly and sue us. So hey people, this is complete idiocy, and just for fun!)

Mold Business Rules - The long awaited Mold Business Rules were released briefly last week, but the rules themselves showed signs of mold. They are currently being tested by an industrial hygienist, and we hope to know soon if they will be salvageable.

Ruling on Timely Notice– in landmark ruling by DOHA, the TSP was deemed to be free of liability for a time machine claimed to be missing at delivery. A special team of investigators had found that the machine was actually in use by the claimant in an attempt to go back in time to rectify their failure to meet the 75 day deadline. This incident was also found to be interesting by the new DPS contractors, who were investigating unexplained date changes in DPS.

New “Turbo-Tax” like claims module – At a recent AMSA conference, SDDC announced that they are definitely looking at trashing the existing DPS claims module, in favor of something more user- friendly, like Turbo Tax. Some concerns with this effort have already been raised however. Having already reached an agreement with the makers of Turbo Tax to use their platform, it was found that payment of a claim at FRV levels constituted income to the U.S. Government, and that the new program would automatically report any settlements to the Internal Revenue Service.

Heard through the Grapevine

-

An adjustor recently denied a claim for a PC with water damage. It turns out that somebody had left windows open.

-

Due to the increase in damages caused by traveling on rough seas, a major steamship line announced this week that they were about to introduce brand new giant cargo submarines. Concerns are already being raised that the decrease in altitude make render plasma TV’s inoperable.

-

After reading the section of the regulations surrounding the payment of Inconvenience claims, an dyslexic adjustor refused to pay for anything but alcoholic beverages.

-

The states bordering on California are set to pass regulations which only allow the old, more pollution prone trucks – just to mess with California.

-

A driver inexplicably acquired a liking for goulash and the ability to speak Hungarian. Doctors feel he may have been bitten by a radioactive Gypsy Moth.

-

A new driver arrived back to his agency, excited by his first over the road assignment, where he delivered a shipment to St. Louis. He claimed to have seen the world’s largest McDonald’s.

-

For years, statistics have shown that top claim item in terms of dollars was scratches to dining room tables. This year however, these tables have fallen to second place, right behind Ostriches that have been made into lamps.

January/February 2014

Mold Working Group - Like a lot of you, no doubt, I create folders and subfolders in Microsoft Outlook for various subjects or email groups. For example, the Mold Working Group, initiated by SDDC to help define procedures and responsibilities to avoid problems with mold on HHG shipments. It was in the process of perusing said folder that I noticed that it has been 2 years now – yes, two years – since we formed this group, and we’re still waiting for a document. But if you see some kind of strange substance forming on our collective efforts, that’s dust – not mold!

At the time of this writing, SDDC was waiting for TRANSCOM to finish reviewing the proposed mold rules. Keep your fingers crossed that they run any modifications by the mold working group before implementation. In the meantime, click here to see an unofficial but nevertheless potentially helpful draft of a proposed “Mold Prevention Checklist.” We see no reason not to use this checklist now, even though it’s not yet been approved or adopted, since it can still help us prevent problems on the front end of the shipment.

Quality Control and the Claims Process – One of the advantages of the direct settlement process is the opportunity it provides to gather specific information regarding just how certain items become lost or damaged - and yet I think we fall short of the mark as an industry in our efforts in this area. One of the services we provide at NCS is to ask the customer if they know what may have contributed to the problem – and if you don’t use NCS, you should probably be asking the question too. You’ll find that while some people just don’t know, many others know exactly what happened, and can give you detailed accounts of improper packing, handling, etc. Ask – or ye shall not receive!

The Myth surrounding crushed cartons - In our humble opinion, the DPS column showing “carton crushed Y/N” often does more harm than good. The data that we’re seeing is wildly unreliable, for a starter. Then, in some people’s minds, a crushed carton means it was mishandled. Not so, I say! Just as often it means that the packer didn’t pack it tight enough.

Coming Events – The Claims Prevention and Procedure Council holds its annual Spring Workshop in St. Louis this year, from April 24-26th. Mekia Bradley from SDDC is slotted to moderate a military round table discussion, and there is also to be a military breakout section moderated by Gary Dootson.

Horse Trading - Otherwise known as the Partial Settlements section of the new business rules, this section provides for a large amount of flexibility in the terms of the settlement, as long as both parties agree. First, the TSP should make an offer for each item based on repair or replacement, but if no agreement results, things can get creative. The settlement may be one lump sum for the whole claim without specifying individual amounts, or may include paying for one item in exchange for dropping a claim for another.

August 2013

Claims Business Rules now in effect (retroactive to July 2, 2013)

The long awaited new claims rules are here. By now, many of you know at least some of what has been changed, but here is my attempt at a “Plain English” synopsis of “What’s New” in the rules. What follows is my own personal interpretation, based on both the actual words and our conversations with government personnel during the course of negotiations. (NCS is not responsible for any hot water any of you get yourselves into because you made settlement decisions based on this blog, so don’t even think about suing us.)

The complete set of rules are here and here is my "Plain English" synopsis:

The complete set of rules are here and here is my "Plain English" synopsis:

1.1.2.2 Sets & Pairs

If the TSP can’t find a replacement for the part of the set that is missing or damaged, the legal obligation is to replace the set, regardless of how much of an impact that one damaged part really made on the value of the set. That being said, everybody at the table agreed that they have no problems on smaller cash offer of some kind, as long as the customer is satisfied. In addition, the TSP’s right to salvage the remainder of the set is always there.

1.7 High Value/High Risk

No longer limited to those items specifically listed on the form or in the regulations, by virtue of the added verbiage “but is not limited to…” So, the protection that the HV/HR inventory offers the TSP, is now NOT limited to that list of items.

2.1.3 MCO must ask TSP for relevant documentation and information BEFORE they pay the claim. This is now a requirement, and should help to cut down on payments made by the MCO to the military member that they perhaps would not have made if they had known all of the facts.

2.3.3 Notice of Loss and Damage

Several changes were made to this section:TSP is required to provide a toll free # and an email. While the MCO’s prefer this to be as close to the time of delivery as possible, the main thing they are looking for is that the TSP has communicated to the customer the correct contact information to start the claims process.

TSP is required to enter delivery dates in DPS within 3 business days of delivery. If they don’t, the 75 days does not start until the shipment is delivered off in DPS.

“If a member requests an extension of the 75 day notice period, the TSP will contact the appropriate MCO before denying any part of the claim for lack of timely notice.”

2.3.5 Repair Estimates

TSP’s must give the customer a copy of the estimate IF they customer requests a copy and the TSP is using it as the basis of settlement. Note: “Redactions of proprietary information are permissible before providing estimate copies.” (For example if the repair firm was a bit “colorful” in describing the state of the home you can take that part out.)

2.4.1 Settlement of Loss and Damage Claims (Appearance Allowances)

“Customers are not required to accept any other settlement options.” (They’re talking about appearance allowances here). This is NOT new – the MCO’s wanted to establish it is not okay to offer an appearance allowance that is unacceptable to the member, and then not give them another option like actual repairs, replacement with salvage, etc. Much discussion took place and again, the MCO’s agree that it is okay with them if the member is happy taking an appearance allowance. The problem was TSP’s who were offering unacceptable appearance allowances and not giving the customer any other options. Any offer that satisfies the member is okay including appearance allowances.

2.5 Partial Settlements (i.e. the “Horse Trading Section”)

This section offers new flexibility, whereby the TSP and customer can enter into more creative settlements, to include a flat amount for the whole claim. There is a strict protocol that must be followed however, so read this section carefully before attempting. The view of the group was that this was not a section that should not be invoked on everyday claims – just once and a while on those claims that call for a bit of extra flexibility.

2.7 Salvage

If customer has already thrown out an item, the TSP’s salvage deduction is 25%. However, if the TSP finds out in the course of settling the claim that the member does not intend to give up salvage, the TSP is not bound by any predetermined percentage by which he can reduce the amount offered. For example, if the customer has a pool table that is not economically repairable but still functions, and he has said he won’t give it up for salvage, the TSP is allowed to offer any amount he deems fair in light of the member’s statement that he’s not giving it up.

There are other subtle changes, but these are most of the more important ones. Watch for more new rules to come out soon on how to handle mold situations.

2013 April Fool's Blog

The following blog entry is just for fun. Not only is it not true, but it may not even be funny. Please do not make large, important business decisions on this completely bogus information.

New Low Value Inventory for DP3 shipments

The new claims business rules will feature an additional option for TSP’s that do DP3 shipments – a special new Low Value Inventory, geared toward identifying and taking precautions not to protect items that have a particularly low value. The customer will be asked to identify any item worth less than $1.00 per pound, and if the customer fails to identify any such items on the form at origin, the TSP can insist on paying him more than $1.00 per pound if they so desire.

Details of New Claims Rules announced

Claims Metrics - After announcing in October of 2012, that Claims Metrics may be back on the table, and then in March that they are no longer being considered, NCS has learned from our special sources that a whole new set of metrics will go into effect starting April 1, 2013. The metrics will be 90% of the Best Value Score, and include scoring the TSP on performance items such as the percentage of left handers on the packing crew, a new version on the “time to settle” metric with TSP’s losing a point for every 10 seconds that pass until settlement, neatness of facial hair and funniness of jokes of the delivery crew.

75 day notice period changed to 75 years – due to a typo that went unnoticed, claimants will now have 75 years to give notice for loss and damage prior to filing a claim. The government felt bad about the error however, and have agreed to use the postmark date for 1851’s dispatched by military claims offices.

2-for-Tuesdays!– Claims filed on Tuesdays now eligible for double FRV – the TSP will, starting April 1, 2013 pay double their normal liability for all claims filed on Tuesdays.

New Release of DPS Claims Module

Offer Acceptance – In addition to the buttons “Accept”, “Forward to MCO” and “Counter offer”, a fourth button “Double Down” will be added to the April 1 release of DPS.

Claim filing when multiple TSP’s are involved – For those shipments that are handled by more than one TSP, the latest release of DPS will randomly choose which TSP has to settle the claim.

You can be a millionaire! - DPS to award a $1,000,000.00 prize to the one millionth claimant in DPS. “There are no limits on number of claims that one claimant can file to try to get the prize”, officials announced.

Steamed Broccoli to be added to Hazardous Items List

“If I’ve seen it once, I’ve seen it a thousand times”, a QC inspector at Fort Bragg who wished to remain anonymous told NCS. Further questioning proved fruitless, as the inspector became too emotional to continue.

New Traffic Management Strategy for 2014 revealed

Efforts to gain efficiency in 2014 have culminated in a new strategy, just announced by government officials. All DOD shipments for the entire year of 2014 are to pack on June 29, load on June 30 and deliver on July 5th.

Software Maker Announces “Even Harder DPS”

Recent improvements to DPS have made it too easy to use, developers told NCS. “Claimants, adjusters, MCO’s – they’re all getting bored with the simplicity and ease of use of DPS’ claims module.” EHDPS includes enhancements such as a Submit button that moves away from your mouse as you try to click on it, and requiring the user to solve quadratic equations when entering the amount claimed.

February 2013

AMSA Workshop: Military Claims

I am presenting an intensive one-day workshop on military claims settlement, and it will be held in Indianapolis on April 18, 2013. It's being held inconjunction with the Claims Prevention and Procedure Council Spring Workshop-see www.claimsnet.org for details about CPPC and the workshop.

Mold: "The New Asbestos"

Somebody at the last IAM meeting said “Mold is the new asbestos”, meaning that it’s one of the current big worries out there that people have, just like when they found out about the cancer causing qualities of asbestos. Sometimes I think the “panic” level is even worse with mold though, because people with mold allergies can indeed get sick quickly when exposed to mold. It also seems that there are a lot more people with mold allergies out there, and while there are various theories about why this is, such as diet, it has nevertheless caused everyone a lot of headache and a lot of money.

We as an entire industry need to be very aware of both mold prevention, and what actions to take once mold is suspected. The following, for example, should be considered mandatory practices:

We as an entire industry need to be very aware of both mold prevention, and what actions to take once mold is suspected. The following, for example, should be considered mandatory practices:

-Never load any part of a shipment where mold is present. Once you accept the shipment, you have problems-even if exceptions have been taken, since nobody is going to want to accept it, and the costs of mitigation are the current TSP's responsibility.

-Inspect shipments that have been in long term or self-storage thoroughly for mold, especially if the shipment smells musty or if you see any signs of a water problem.

-Never deliver moldy items to a customer's house under any circumstances. It's not worth the health risks, or having the problem spread to ductwork and carpeting, etc.

January 2013

High Value/High Risk Forms-still not being used correctly

It is the opinion of this writer that we still have an industry-wide problem with respect to the proper utilization of High Value/High Risk forms on military shipments. There is protection for the member and the TSP if used correctly. If the form is properly executed, no claim can be filed for missing HV/HR items unless they are noted missing at the time of delivery. In addition, TSP liability is limited to $100.00 per pound for qualified high value items, if the member does not ensure that they are listed on the form.

The following are just a few points that need to be communicated down to the agents and drivers:

-

The packer should be required by the TSP written policy to be responsible for the inclusion of High Risk Items - while High Value items are limited to those described in the business rules, high risk can include anything the TSP wants to include, like CD's and DVD's, electronics, etc.

-

HV/HR items must be recorded on the regular inventory.

-

Numbered security seals for each HV/HR carton should be used, and seal numbers recorded.

-

There MUST be a mandatory unpack for all HV/HR cartons at delivery, and the right most column for customer initials MUST be filled out for the TSP to be protected against later noted loss.

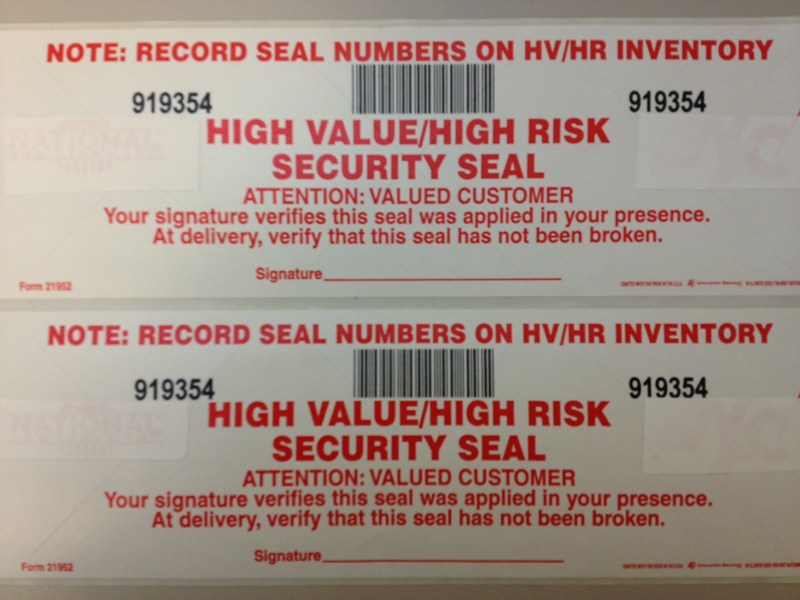

Example of High Value Security Seals

They should be placed on the seals at the top and bottom of the carton

Member should sign each seal

Number on the seal should be recorded on the High Risk High Value inventory

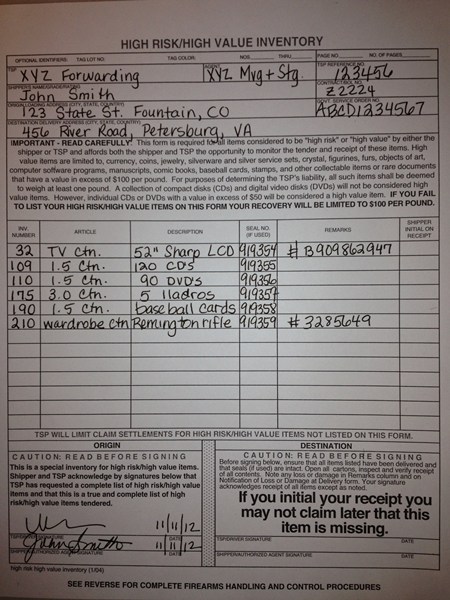

Example of High Risk High Value Inventory recorded at origin

All fields are filled in

Each line item has a serial number associated with it

High Value and High Risk items are noted

Regarding firearms the government requires the regular inventory to include:

Example of High Risk High Value Inventory recorded at origin

All fields are filled in

Each line item has a serial number associated with it

High Value and High Risk items are noted

Regarding firearms the government requires the regular inventory to include:

-

Make

-

Model

-

Serial Number

-

Caliber or gage of the firearm

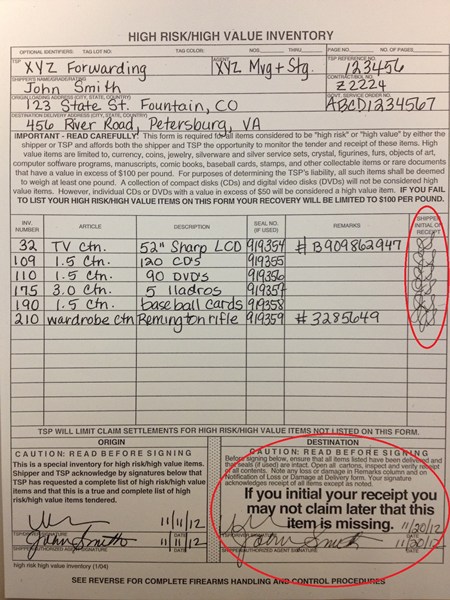

Example of High Risk High Value Inventory Completed at Destination

Each item is initialed as received

Customer signed off all items received and they may not claim later that these items are missing

Example of High Risk High Value Inventory Completed at Destination

Each item is initialed as received

Customer signed off all items received and they may not claim later that these items are missing

Miscellaneous Claims Shorts

-

MCO personnel and industry representatives are still working on the new claims business rules, and as of this writing the ball was in the MCO's court, waiting for them to finalize the latest draft and send to industry.

-

The Claims Prevention and Procedure Council meeting will be held on April 19 & 20 in Indianapolis. For more information go to www.claimsnet.org

-

Watch for a possible AMSA Military Claims Training Workshop to be held in Santa Barbara, California in mid-May, in conjunction with the California Moving & Storage Association Meeting. Details will be available on www.promover.org when the plans are finalized.

November 2012

IAM Annual Meeting/Claims Panel

During the annual meeting of the International Association of Movers, I again had the honor of being on the Claims Panel. The special two-hour claims panel is well attended by industry and some of the high level government personnel that are invited to IAM. The main focus of this year’s claims panel was mold and mildew, and the problems presented by mold in terms of both mitigation and liability. I also serve on a special committee formed by SDDC to tackle the mold problems inherent particularly in the International arena. Other panelists included the lead attorneys from Army, Air Force, and Navy Claims, as well as Tyler Smith and Peg Wilken from industry.

serve on a special committee formed by SDDC to tackle the mold problems inherent particularly in the International arena. Other panelists included the lead attorneys from Army, Air Force, and Navy Claims, as well as Tyler Smith and Peg Wilken from industry.

Business Rules Meeting (Claims)

I am happy to say that our small working group has in my view the best working relationship of any other group that includes both industry and government personnel. The working group included the following individuals, and the purpose of the meeting was to go over some changes proposed by both sides to the 400NG language that deals with claims.

-

Brett Coakley, Attorney-Advisor, Air Force Claims

-

Steve Kelly, Chief, Personnel Claims Branch, U.S. Army Claims Service

-

Virginia Eilmus, Head, Personnel Claims Unit Norfolk, U.S. Navy JAG

-

Scott Michael, Vice President, Military & Government Relations, American Moving & Storage Association

-

Peggy Wilken, Vice President of Government Traffic, Stevens Worldwide Van Lines

-

Chuck White, Director of Government & Military Relations, International Association of Movers

-

Tyler Smith, Senior Manager, Claims & Quality Assurance, Government Logistics N.V. (Germany)

-

Kevin Spealman, Vice President, Claims & Customer Service, National Forwarding Co.

We met for over four hours, and we made it through the entire claims section of the 400NG. While the verbiage still needs to be written for some areas, we did reach consensus on most all issues. New proposed verbiage that would have posed an onerous burden on the industry was eliminated, and overall it was a very successful session.

Claims Metrics (again)

Perhaps because Halloween has just passed, I am reminded of the Zombies that just won’t die in some of the old horror flicks. We really did feel that claims metrics was a dead issue, since it seemed that everyone on both sides of the aisle agreed that the data in DPS was bad data, and that there was no discernible way to fix that. Whether it is due to pressure from above, or just forgetting past discussions, it was discovered during the IAM meeting that the government will “turn on” claims metrics in early 2013, to “see if they work.” Like most of the industry, it is our belief here at National that much more harm than good will come out of the utilization of claims metrics in the Best Value Score (BVS), as they were outlined in their original form. Industry will need to make a concerted effort to not only convince SDDC and other government entities that the metrics as written are a “bad idea,” but we are also going to have to be ready to provide solutions. Here are some important points.

-

Metrics were, contrary to popular belief, NOT part of the original 70/30 split, and were only added after the fact after Air Force Claims officials requested them.

-

The claims metrics as outlined would be an inordinately large part of the performance score in the BVS, to the point where the rest of the score would almost be rendered meaningless.

-

It is to the advantage of all TSPs with integrity to assist the government in the identification and elimination of TSPs that openly cheat the service member and/or the U.S. Government. We should assist the government in their efforts to keep out the bad applies therefore, and to once and for all discard the notion of including claims metrics in the Best Value Score.